Analyzing the Rise of DeFi Tokens

- Understanding the Basics of DeFi Tokens

- Exploring the Evolution of DeFi Tokens in the Cryptocurrency Market

- The Impact of DeFi Tokens on Traditional Finance Systems

- Challenges and Opportunities in the DeFi Token Ecosystem

- Key Factors Driving the Surge in DeFi Token Adoption

- Future Trends and Predictions for DeFi Tokens in the Financial Industry

Understanding the Basics of DeFi Tokens

Decentralized Finance (DeFi) tokens have gained significant popularity in the cryptocurrency market in recent years. These tokens are digital assets that operate on blockchain technology, allowing users to engage in various financial activities without the need for traditional intermediaries such as banks or brokers.

Understanding the basics of DeFi tokens is essential for investors looking to capitalize on this growing trend. DeFi tokens are typically used within decentralized applications (dApps) that offer a range of financial services, including lending, borrowing, trading, and more. These tokens can also be staked or used to participate in governance decisions within the DeFi ecosystem.

Investors should be aware that DeFi tokens can be highly volatile, with prices subject to rapid fluctuations based on market demand and other factors. It is crucial to conduct thorough research and due diligence before investing in DeFi tokens to mitigate risks and maximize potential returns.

Overall, DeFi tokens represent an exciting opportunity for investors to participate in the future of finance. By understanding the basics of these tokens and staying informed about market trends, investors can position themselves to take advantage of the growing DeFi ecosystem and potentially generate significant profits.

Exploring the Evolution of DeFi Tokens in the Cryptocurrency Market

DeFi tokens have been a significant development in the cryptocurrency market, revolutionizing the way individuals interact with financial services. These tokens are built on blockchain technology, allowing for decentralized and automated transactions without the need for traditional intermediaries. As a result, DeFi tokens have gained popularity among investors looking for more efficient and transparent ways to manage their assets.

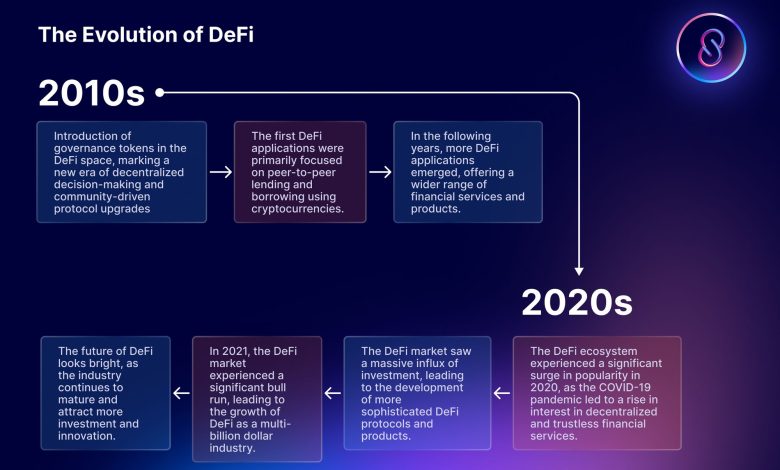

One of the key aspects of DeFi tokens is their evolution over time. These tokens have gone through several phases of development, each bringing new features and capabilities to the market. Initially, DeFi tokens were primarily used for simple transactions and lending. However, as the technology matured, more complex financial products such as decentralized exchanges and yield farming emerged.

As DeFi tokens continue to evolve, they are becoming increasingly integrated into the broader cryptocurrency ecosystem. This integration has led to a surge in the number of DeFi projects and tokens available to investors. With this growth, the market for DeFi tokens has become more competitive, with projects vying for users and liquidity.

The Impact of DeFi Tokens on Traditional Finance Systems

DeFi tokens have been making waves in the financial world, challenging traditional finance systems and revolutionizing the way people interact with money. The impact of DeFi tokens on traditional finance systems is profound, as they offer a decentralized alternative to traditional banking and investment options.

One of the key ways in which DeFi tokens are disrupting traditional finance systems is by providing users with greater control over their assets. Unlike traditional banks, which act as intermediaries in financial transactions, DeFi tokens allow users to interact directly with the blockchain, enabling peer-to-peer transactions without the need for a middleman.

Furthermore, DeFi tokens are also changing the way people think about investing. By offering decentralized lending and borrowing platforms, DeFi tokens are opening up new opportunities for individuals to access capital and earn passive income through staking and yield farming.

Overall, the rise of DeFi tokens is reshaping the financial landscape, challenging traditional finance systems, and empowering individuals to take control of their financial futures. As more people become aware of the benefits of DeFi tokens, it is likely that they will continue to gain traction and disrupt traditional finance systems even further.

Challenges and Opportunities in the DeFi Token Ecosystem

The DeFi token ecosystem presents a range of challenges and opportunities for investors and developers alike. Understanding these factors is crucial for navigating this rapidly evolving landscape.

One of the main challenges in the DeFi token ecosystem is the issue of security. With the decentralized nature of these tokens, there is an increased risk of hacks and vulnerabilities. Developers must constantly work to improve security measures to protect users’ funds.

Another challenge is the regulatory uncertainty surrounding DeFi tokens. As governments around the world grapple with how to classify and regulate these assets, investors may face legal risks. It is essential to stay informed about the latest regulatory developments to mitigate these risks.

Despite these challenges, the DeFi token ecosystem also offers significant opportunities. One of the main advantages of DeFi tokens is their ability to provide financial services to underserved populations. By leveraging blockchain technology, these tokens can facilitate access to banking, lending, and other financial services for individuals who are excluded from traditional financial systems.

Furthermore, DeFi tokens have the potential to revolutionize the way we think about finance. By eliminating intermediaries and enabling peer-to-peer transactions, these tokens can reduce costs and increase efficiency in the financial sector. This could lead to a more inclusive and transparent financial system for all participants.

Key Factors Driving the Surge in DeFi Token Adoption

The surge in DeFi token adoption can be attributed to several key factors driving the growth of this sector. These factors have contributed to the increasing popularity of decentralized finance and the tokens associated with it.

- **Interoperability**: One of the main drivers of DeFi token adoption is the interoperability of different platforms and protocols. This allows users to seamlessly move assets between various DeFi applications, increasing the efficiency and usability of the ecosystem.

- **Yield Farming**: Another factor fueling the surge in DeFi token adoption is the concept of yield farming, where users can earn rewards by providing liquidity to decentralized exchanges and other platforms. This incentivizes users to participate in the DeFi ecosystem and drives up the demand for DeFi tokens.

- **Decentralized Governance**: DeFi tokens often come with governance rights, allowing holders to vote on proposals and changes to the protocol. This decentralized governance model gives users a sense of ownership and control over the platform, attracting more participants to the ecosystem.

- **Innovation**: The constant innovation in the DeFi space, with new protocols and applications being developed regularly, has also contributed to the surge in token adoption. Users are drawn to the potential for high returns and novel financial products offered by these platforms.

- **Security**: Despite some high-profile hacks in the DeFi space, security measures are continuously being improved to protect user funds. This increased focus on security has helped build trust in the DeFi ecosystem and encouraged more users to adopt DeFi tokens.

Future Trends and Predictions for DeFi Tokens in the Financial Industry

As we look towards the future of DeFi tokens in the financial industry, several trends and predictions are emerging that could shape the landscape of decentralized finance. One of the key trends is the continued growth and adoption of DeFi protocols across various sectors of the financial industry. These protocols offer users the ability to access financial services without the need for traditional intermediaries, providing greater transparency and efficiency in the process.

Another trend to watch is the increasing integration of DeFi tokens into traditional financial markets. As more institutional investors and traditional financial institutions recognize the potential of DeFi, we can expect to see greater collaboration and integration between these two worlds. This could lead to increased liquidity and stability in the DeFi market, as well as greater mainstream adoption of these tokens.

Looking ahead, one prediction for DeFi tokens is the continued development of innovative use cases and applications. With the rise of decentralized autonomous organizations (DAOs) and non-fungible tokens (NFTs), we can expect to see new ways in which DeFi tokens are utilized within the financial industry. These developments could open up new opportunities for investors and users alike, driving further growth in the DeFi space.