The Role of Insurance in Protecting Crypto Investments

- The importance of insurance in the volatile world of cryptocurrency

- How insurance can provide peace of mind for crypto investors

- Understanding the risks of investing in cryptocurrency and how insurance can help mitigate them

- The evolving landscape of insurance options for crypto investments

- Key factors to consider when choosing insurance for your crypto portfolio

- Case studies of insurance success stories in the crypto space

The importance of insurance in the volatile world of cryptocurrency

In the volatile world of cryptocurrency, the importance of insurance cannot be overstated. With the ever-changing landscape of digital assets and the inherent risks involved, having insurance coverage can provide much-needed protection for investors.

Insurance can help mitigate the potential losses that may arise from cyber attacks, hacks, fraud, or other unforeseen events in the crypto market. By having insurance in place, investors can have peace of mind knowing that their investments are safeguarded against these risks.

Moreover, insurance can also help boost investor confidence in the cryptocurrency market. Knowing that there is a safety net in place can attract more investors to the space, ultimately leading to a more stable and secure market environment.

In conclusion, insurance plays a crucial role in protecting crypto investments in today’s unpredictable market. It provides a layer of security and peace of mind for investors, ultimately contributing to the overall stability and growth of the cryptocurrency industry.

How insurance can provide peace of mind for crypto investors

Insurance can play a crucial role in providing peace of mind for cryptocurrency investors. With the volatile nature of the crypto market, investors are constantly exposed to risks such as hacking, fraud, and theft. By having insurance coverage in place, investors can protect their investments from potential losses.

One of the key benefits of insurance for crypto investors is the ability to transfer the risk of financial loss to an insurance company. In the event of a security breach or other unforeseen circumstances, insurance can help cover the costs associated with recovering lost funds or assets. This can help investors mitigate their losses and continue to participate in the crypto market with confidence.

Furthermore, insurance can also provide investors with a sense of security and stability in an otherwise unpredictable market. Knowing that their investments are protected by insurance can help investors make more informed decisions and take calculated risks when it comes to their crypto holdings.

Overall, insurance can be a valuable tool for crypto investors looking to safeguard their investments and navigate the risks associated with the crypto market. By having insurance coverage in place, investors can have peace of mind knowing that they are protected against potential losses and can continue to invest in cryptocurrencies with confidence.

Understanding the risks of investing in cryptocurrency and how insurance can help mitigate them

Investing in cryptocurrency can be a lucrative opportunity, but it also comes with its fair share of risks. The volatile nature of the market means that prices can fluctuate dramatically in a short period of time, leading to potential losses for investors. Additionally, the lack of regulation in the cryptocurrency space means that there is a higher risk of fraud and hacking.

Insurance can help mitigate some of these risks by providing coverage for losses due to theft, fraud, or other unforeseen circumstances. By insuring your crypto investments, you can have peace of mind knowing that you are protected in case the worst happens. Some insurance policies even offer coverage for losses due to exchange hacks or other security breaches.

It’s important to carefully consider the risks involved in investing in cryptocurrency and to take steps to protect your investments. Insurance can be a valuable tool in managing these risks and providing added security for your crypto portfolio. By working with a reputable insurance provider, you can ensure that your investments are safeguarded against potential threats in the volatile world of cryptocurrency.

The evolving landscape of insurance options for crypto investments

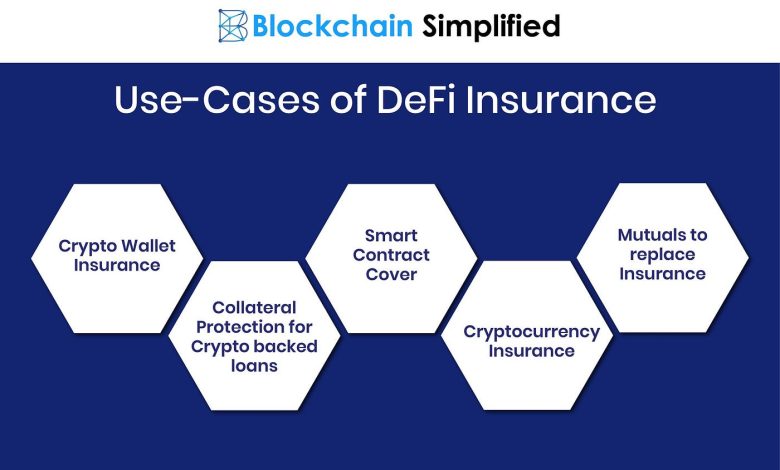

As the popularity of cryptocurrencies continues to rise, the landscape of insurance options for protecting crypto investments is also evolving. Investors are increasingly seeking ways to safeguard their digital assets from potential risks such as hacking, theft, and fraud. In response to this growing demand, insurance companies are starting to offer specialized policies tailored to the unique needs of cryptocurrency holders.

One of the key developments in this space is the emergence of crypto-specific insurance products that cover losses related to the theft of digital assets from online exchanges or wallets. These policies typically provide coverage for both hot wallets (online storage) and cold wallets (offline storage), giving investors peace of mind knowing that their funds are protected against cyber threats.

Another trend in the insurance industry is the integration of blockchain technology to streamline the claims process and enhance transparency. By leveraging blockchain, insurers can verify the authenticity of transactions and ensure that claims are processed efficiently. This not only benefits policyholders by expediting the payout process but also helps insurers mitigate fraud risks.

Furthermore, some insurance providers are exploring innovative solutions such as smart contracts and decentralized autonomous organizations (DAOs) to automate the underwriting and claims settlement processes. These technologies have the potential to revolutionize the insurance industry by reducing administrative costs and improving the overall customer experience.

In conclusion, the evolving landscape of insurance options for crypto investments reflects the growing recognition of the importance of protecting digital assets in an increasingly digitized world. By staying informed about the latest developments in this space and exploring different insurance options, investors can effectively mitigate risks and safeguard their crypto holdings for the long term.

Key factors to consider when choosing insurance for your crypto portfolio

When selecting insurance for your cryptocurrency portfolio, there are several key factors to take into consideration to ensure your investments are adequately protected.

- Reputation: Choose an insurance provider with a strong reputation in the industry to guarantee reliability and trustworthiness.

- Coverage: Look for a policy that offers comprehensive coverage for various risks such as theft, hacking, and fraud.

- Security: Ensure that the insurance provider has robust security measures in place to safeguard your assets.

- Cost: Compare premiums from different insurers to find a policy that offers the best value for your money.

- Claims Process: Evaluate the ease and efficiency of the claims process to expedite any potential payouts in the event of a loss.

By considering these factors carefully, you can select the right insurance policy to protect your crypto investments and provide yourself with peace of mind.

Case studies of insurance success stories in the crypto space

There have been several insurance success stories in the crypto space that highlight the importance of having proper insurance coverage for crypto investments. One such case study involves a crypto exchange that was hacked, resulting in the loss of millions of dollars worth of digital assets. However, because the exchange had insurance against cyber attacks, they were able to recover a significant portion of the stolen funds through their insurance policy.

Another success story in the crypto insurance realm is that of a crypto wallet provider that experienced a security breach, leading to the loss of customer funds. Thanks to their insurance coverage, the company was able to compensate all affected customers and rebuild their reputation in the crypto community.

These case studies demonstrate the value of having insurance in place to protect crypto investments from unexpected events such as hacks and security breaches. By mitigating risks through insurance policies, crypto businesses can ensure the security and protection of their assets and customers in the volatile crypto market.