Future Trends in Crypto Security Measures

- The Evolution of Cryptocurrency Security

- Emerging Technologies in Crypto Security

- Challenges and Solutions in Securing Digital Assets

- The Role of Blockchain in Enhancing Security

- Regulatory Developments Impacting Crypto Security

- Best Practices for Safeguarding Cryptocurrency Investments

The Evolution of Cryptocurrency Security

Cryptocurrency security has evolved significantly over the years to address the growing threats in the digital landscape. **Innovations** in encryption techniques, multi-factor authentication, and decentralized storage have played a crucial role in enhancing the security of digital assets. **These advancements** have made it increasingly difficult for hackers to compromise cryptocurrency wallets and exchanges.

One of the key developments in cryptocurrency security is the implementation of **multi-signature** wallets. These wallets require multiple private keys to authorize a transaction, adding an extra layer of security. **This** significantly reduces the risk of unauthorized access and theft. **Furthermore**, the use of biometric authentication, such as fingerprint or facial recognition, has become more prevalent in securing cryptocurrency transactions.

Another important aspect of cryptocurrency security is the emergence of decentralized exchanges. **These platforms** do not hold users’ funds, reducing the risk of large-scale hacks. **Instead**, transactions are conducted directly between users through smart contracts, eliminating the need for a central authority to facilitate trades. **This** decentralized approach minimizes the risk of a single point of failure and enhances the overall security of the exchange.

Moreover, advancements in blockchain technology have led to the development of **privacy** coins that offer enhanced anonymity and security features. **These** coins utilize advanced cryptographic techniques to obfuscate transaction details, making it difficult to trace the flow of funds. **This** increased privacy protection is particularly appealing to users who prioritize anonymity in their transactions.

Overall, the evolution of cryptocurrency security measures has been driven by the need to stay ahead of cyber threats and protect users’ digital assets. **By** leveraging cutting-edge technologies and innovative solutions, the crypto community continues to enhance the security of digital transactions and storage. **As** the industry evolves, it is crucial for users to stay informed about the latest security trends and best practices to safeguard their investments in the ever-changing digital landscape.

Emerging Technologies in Crypto Security

As the landscape of crypto security continues to evolve, emerging technologies are playing a crucial role in enhancing the protection of digital assets. These advancements are aimed at addressing the growing concerns around cybersecurity threats and vulnerabilities in the crypto space.

One of the key technologies making waves in the realm of crypto security is multi-factor authentication. This approach adds an extra layer of security by requiring users to provide multiple forms of verification before gaining access to their accounts. By combining something the user knows (like a password) with something they have (like a mobile device), multi-factor authentication significantly reduces the risk of unauthorized access.

Biometric authentication is another cutting-edge technology that is being increasingly adopted in the crypto industry. By using unique physical characteristics such as fingerprints, facial recognition, or iris scans, biometric authentication offers a highly secure way to verify the identity of users. This not only enhances security but also provides a more convenient and user-friendly experience.

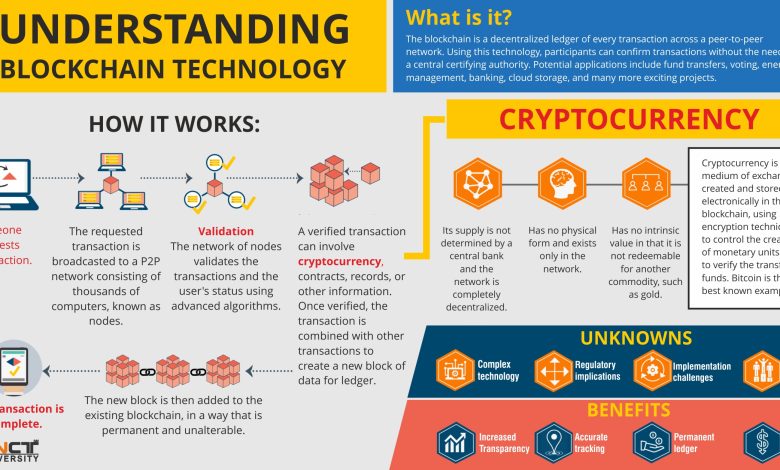

Blockchain technology itself is also playing a pivotal role in strengthening crypto security measures. By leveraging the decentralized and immutable nature of blockchain, security protocols can be implemented to protect sensitive data and transactions. The transparency and tamper-proof nature of blockchain make it an ideal solution for enhancing the overall security of crypto assets.

Furthermore, quantum-resistant cryptography is emerging as a promising solution to safeguard crypto assets against potential threats from quantum computers. As quantum computing continues to advance, traditional cryptographic methods may become vulnerable to attacks. Quantum-resistant cryptography utilizes algorithms that are designed to withstand the computational power of quantum computers, ensuring the long-term security of crypto assets.

In conclusion, the integration of these emerging technologies is reshaping the landscape of crypto security and providing innovative solutions to combat evolving threats. By staying ahead of the curve and adopting these advanced security measures, crypto users can mitigate risks and protect their digital assets in an increasingly interconnected and digital world.

Challenges and Solutions in Securing Digital Assets

Securing digital assets in the realm of cryptocurrency presents a myriad of challenges that require innovative solutions to mitigate risks effectively. One of the primary challenges is the vulnerability of online wallets to cyber attacks, which can result in the loss of valuable assets. To address this issue, implementing multi-factor authentication and encryption techniques can significantly enhance the security of digital wallets.

Another critical challenge is the threat of phishing scams and social engineering tactics used by malicious actors to gain unauthorized access to sensitive information. Educating users about the importance of verifying the authenticity of websites and emails can help prevent falling victim to these fraudulent schemes. Additionally, utilizing hardware wallets and cold storage solutions can provide an extra layer of protection against unauthorized access.

Furthermore, the evolving nature of cyber threats requires constant monitoring and updating of security measures to stay ahead of potential risks. Regular security audits and penetration testing can help identify vulnerabilities and weaknesses in existing systems, allowing for timely remediation before any breaches occur. Collaborating with cybersecurity experts and staying informed about the latest trends in digital security can also aid in developing robust defense mechanisms against emerging threats.

The Role of Blockchain in Enhancing Security

Blockchain technology plays a crucial role in enhancing security measures within the realm of cryptocurrency. By utilizing a decentralized and immutable ledger, blockchain provides a high level of transparency and trust in transactions. This technology ensures that all transactions are securely recorded and verified by a network of nodes, making it extremely difficult for malicious actors to manipulate the data.

One of the key features of blockchain is its ability to provide cryptographic security through the use of public and private keys. These keys ensure that only authorized individuals can access and transfer funds, adding an extra layer of protection to the system. Additionally, blockchain’s consensus mechanisms, such as proof of work or proof of stake, help to prevent fraudulent activities and maintain the integrity of the network.

Furthermore, blockchain technology enables the implementation of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. Smart contracts help to automate processes and eliminate the need for intermediaries, reducing the risk of human error or fraud. This not only enhances security but also increases efficiency and reduces costs in cryptocurrency transactions.

Regulatory Developments Impacting Crypto Security

Recent regulatory developments have had a significant impact on the landscape of crypto security. Governments around the world are increasingly focusing on implementing measures to regulate the use of cryptocurrencies and ensure the security of digital assets. These regulations aim to protect investors, prevent fraud, and combat money laundering and other illicit activities in the crypto space.

One key area of focus for regulators is the security of crypto exchanges. Many countries are now requiring exchanges to comply with strict security standards to protect user funds and data. This includes measures such as implementing multi-factor authentication, conducting regular security audits, and storing a significant portion of funds in cold wallets to prevent hacking.

Additionally, regulators are also looking at ways to enhance the security of initial coin offerings (ICOs) and token sales. This includes requiring companies to conduct thorough due diligence on investors, provide clear and transparent information about their projects, and implement measures to prevent fraud and scams.

Overall, these regulatory developments are aimed at creating a more secure and trustworthy environment for the use of cryptocurrencies. By implementing these measures, regulators hope to encourage greater adoption of digital assets while protecting investors and preventing illicit activities in the crypto space.

Best Practices for Safeguarding Cryptocurrency Investments

When it comes to safeguarding your cryptocurrency investments, there are several best practices that you should follow to ensure the security of your digital assets. By implementing these measures, you can protect your investments from potential threats and minimize the risk of loss.

- Use a Hardware Wallet: One of the most secure ways to store your cryptocurrency is by using a hardware wallet. These devices store your private keys offline, making them less vulnerable to hacking attacks.

- Enable Two-Factor Authentication: Adding an extra layer of security to your accounts by enabling two-factor authentication can help prevent unauthorized access to your funds.

- Keep Your Software Updated: Regularly updating your wallet software and operating system can help patch any security vulnerabilities that hackers could exploit.

- Avoid Phishing Scams: Be cautious of emails or messages asking for your private keys or personal information. Always verify the source before sharing any sensitive data.

- Diversify Your Investments: Instead of putting all your funds into one type of cryptocurrency, consider diversifying your portfolio to spread out the risk.

By following these best practices, you can enhance the security of your cryptocurrency investments and protect them from potential threats. Remember that the crypto market is constantly evolving, so staying informed about the latest security measures is crucial to safeguarding your digital assets.