The Impact of Bitcoin Halving on the Market

- Understanding Bitcoin Halving and its significance

- Historical trends of Bitcoin price before and after halving events

- How Bitcoin halving affects miners and the mining industry

- The role of supply and demand in the Bitcoin market post-halving

- Expert predictions on the future of Bitcoin post-halving

- Potential risks and opportunities for investors during Bitcoin halving

Understanding Bitcoin Halving and its significance

Bitcoin halving is an event that occurs approximately every four years, during which the rewards miners receive for validating transactions on the Bitcoin network are cut in half. This process is built into the Bitcoin protocol to control the supply of new bitcoins entering circulation. The significance of Bitcoin halving lies in its impact on the overall supply and demand dynamics of the cryptocurrency.

When Bitcoin halving occurs, the rate at which new bitcoins are created decreases, leading to a reduction in the available supply. This scarcity can drive up the price of Bitcoin as demand remains constant or even increases. As a result, Bitcoin halving is often associated with bullish market sentiment and has historically been followed by significant price rallies.

Investors and traders closely monitor Bitcoin halving events as they can have a profound effect on the market. The anticipation of reduced supply and potential price appreciation can lead to increased buying activity in the lead-up to the halving. Conversely, some market participants may sell off their holdings after the event to capitalize on any price spikes that occur.

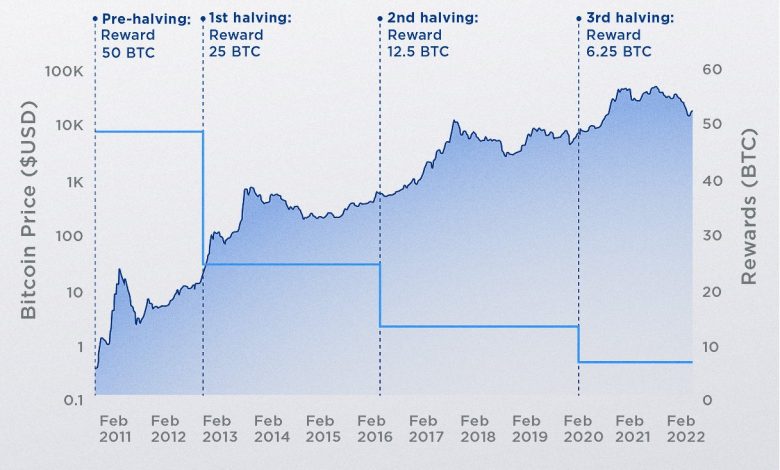

Historical trends of Bitcoin price before and after halving events

Bitcoin halving events have historically had a significant impact on the price of the cryptocurrency. Before a halving event occurs, there is typically a period of increased speculation and anticipation in the market. This often leads to a rise in the price of Bitcoin as investors buy in ahead of the event to capitalize on potential price increases.

After a halving event takes place, there is usually a short-term dip in the price of Bitcoin as some investors take profits. However, this is often followed by a period of sustained price growth as the reduced supply of new coins entering the market leads to increased scarcity. This scarcity can drive up demand and push the price of Bitcoin higher over time.

Looking back at historical trends, we can see that the price of Bitcoin has tended to increase significantly in the months and years following a halving event. For example, after the first halving event in 2012, the price of Bitcoin surged from around $12 to over $1000 within a year. Similarly, after the second halving event in 2016, the price of Bitcoin climbed from around $650 to nearly $20,000 by the end of 2017.

Overall, the historical data suggests that Bitcoin halving events have a positive long-term impact on the price of the cryptocurrency. While short-term price fluctuations are common, the overall trend has been one of growth and appreciation. Investors and traders should consider these historical trends when making decisions about buying or selling Bitcoin around halving events.

How Bitcoin halving affects miners and the mining industry

Bitcoin halving has a significant impact on miners and the mining industry as a whole. When Bitcoin undergoes halving, the rewards for miners are reduced by half. This means that miners receive fewer bitcoins for verifying transactions on the blockchain. As a result, miners may experience a decrease in their profits, which can affect their operations and sustainability.

Miners need to adapt to the changes brought about by Bitcoin halving in order to remain profitable. Some miners may choose to upgrade their mining equipment to increase their efficiency and stay competitive in the market. Others may decide to join mining pools to combine their resources and increase their chances of earning rewards. Additionally, some miners may explore alternative cryptocurrencies to mine in order to diversify their income streams.

The mining industry as a whole may also experience shifts as a result of Bitcoin halving. Some smaller mining operations may be forced to shut down if they are unable to cover their operating costs with reduced rewards. This could lead to consolidation in the mining industry, with larger players acquiring smaller operations to increase their market share.

The role of supply and demand in the Bitcoin market post-halving

The dynamics of the Bitcoin market are heavily influenced by the interplay between supply and demand, especially in the aftermath of the halving event. The reduction in the rate at which new Bitcoins are created leads to a decrease in the available supply, which can potentially drive up the price due to scarcity. This scarcity can create a sense of urgency among investors, causing an increase in demand for the limited supply of Bitcoins.

Post-halving, the market typically experiences a period of adjustment as participants recalibrate their strategies in response to the new supply dynamics. Miners may find it more challenging to sustain their operations with reduced block rewards, leading to a potential decrease in the supply of newly minted Bitcoins. This shift in the supply side of the equation can further impact the market dynamics, influencing price movements and investor sentiment.

On the demand side, the halving event can act as a catalyst for increased interest in Bitcoin as an asset class. The perceived scarcity of Bitcoins post-halving may attract new investors looking to capitalize on potential price appreciation. Additionally, the halving event often garners media attention, raising awareness about Bitcoin and its investment potential, further fueling demand in the market.

Expert predictions on the future of Bitcoin post-halving

Experts have varying opinions on the future of Bitcoin post-halving. Some analysts predict that the price of Bitcoin will surge in the months following the halving event, citing historical data and market trends. They believe that the reduction in the supply of new Bitcoins will drive up demand and ultimately lead to an increase in value.

On the other hand, some experts are more cautious in their predictions, suggesting that the impact of halving may not be as significant as previously thought. They argue that the market has already priced in the event, and any potential price increase may be short-lived. Additionally, they point to external factors such as regulatory developments and macroeconomic trends that could influence the price of Bitcoin in the long term.

Overall, it is clear that the halving event will have a profound impact on the market. Whether Bitcoin will reach new heights or experience a period of consolidation remains to be seen. Investors should carefully consider these expert predictions and conduct their own research before making any decisions in the post-halving landscape.

Potential risks and opportunities for investors during Bitcoin halving

Investors need to be aware of the potential risks and opportunities that come with Bitcoin halving. This event can have a significant impact on the market, leading to both positive and negative outcomes. It is essential to understand these factors to make informed decisions when investing in Bitcoin.

- One potential risk for investors during Bitcoin halving is increased volatility in the market. As the supply of new Bitcoins is reduced, the price of Bitcoin can fluctuate more dramatically. This volatility can lead to significant losses for investors who are not prepared for sudden price changes.

- On the other hand, Bitcoin halving also presents opportunities for investors. Historically, Bitcoin prices have surged following halving events as demand outstrips supply. This can result in substantial profits for investors who hold onto their Bitcoin during these periods.

- Another risk to consider is the possibility of a “halving dump,” where some investors sell off their Bitcoin holdings after the halving event, causing prices to drop. This can create buying opportunities for investors looking to enter the market at lower prices.

- Additionally, regulatory changes and market sentiment can also impact the price of Bitcoin during halving. Investors should stay informed about any developments that could affect the market to mitigate risks and capitalize on opportunities.

In conclusion, while Bitcoin halving presents both risks and opportunities for investors, staying informed and being prepared can help navigate the market effectively. By understanding the potential outcomes of this event, investors can make strategic decisions to maximize their returns and minimize losses.