How Market Sentiment Affects Crypto Prices

- Understanding Market Sentiment in the Crypto World

- The Psychology Behind Crypto Price Movements

- Analyzing the Impact of Investor Emotions on Cryptocurrency Prices

- Market Sentiment Indicators and Their Influence on Crypto Markets

- How Fear and Greed Drive Cryptocurrency Price Fluctuations

- Strategies for Navigating Volatile Crypto Markets Based on Market Sentiment

Understanding Market Sentiment in the Crypto World

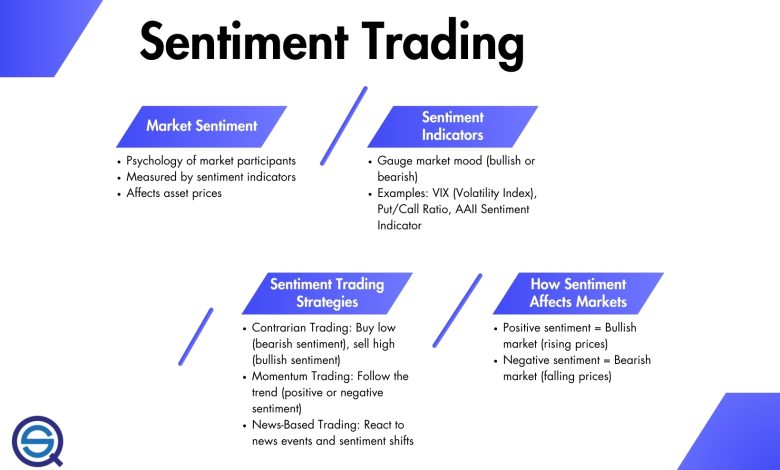

Understanding market sentiment in the crypto world is crucial for investors looking to make informed decisions. Market sentiment refers to the overall feeling or attitude of traders and investors towards a particular cryptocurrency. This sentiment can be influenced by various factors such as news, social media, and market trends.

One way to gauge market sentiment is through sentiment analysis tools that use algorithms to analyze social media posts, news articles, and other sources of information to determine whether the overall sentiment is positive, negative, or neutral. By understanding market sentiment, investors can get a sense of how the market is feeling about a particular cryptocurrency and make decisions accordingly.

Market sentiment can have a significant impact on crypto prices. If the market sentiment is positive, investors may be more willing to buy, driving up the price of the cryptocurrency. On the other hand, if the sentiment is negative, investors may be more inclined to sell, causing the price to drop. It’s essential to keep an eye on market sentiment to anticipate potential price movements and adjust your investment strategy accordingly.

The Psychology Behind Crypto Price Movements

The psychology behind crypto price movements is a fascinating aspect of the market that often goes overlooked. Understanding how human emotions and behaviors influence the value of cryptocurrencies can provide valuable insights for investors and traders alike.

One key concept to consider is the role of market sentiment in driving price fluctuations. **Investors** and traders are not always rational actors; their decisions can be influenced by fear, greed, and other emotions. When sentiment is positive, prices tend to rise as more people buy in, driving up demand. Conversely, when sentiment is negative, prices can plummet as investors panic sell.

Another important factor to consider is the impact of social media and news on crypto prices. **Information** spreads rapidly in the digital age, and a single tweet or news article can cause prices to soar or plummet within minutes. Traders who are able to stay ahead of the news cycle can capitalize on these rapid price movements.

Additionally, **technical analysis** plays a crucial role in understanding crypto price movements. By studying historical price data and chart patterns, traders can identify trends and make more informed decisions about when to buy or sell. This can help mitigate the impact of emotional decision-making on investment outcomes.

Overall, the psychology behind crypto price movements is a complex and multifaceted topic that requires a deep understanding of human behavior, market dynamics, and technical analysis. By staying informed and aware of these factors, investors can navigate the volatile crypto market with more confidence and success.

Analyzing the Impact of Investor Emotions on Cryptocurrency Prices

Investor emotions play a significant role in influencing the prices of cryptocurrencies in the market. The sentiment of investors towards a particular cryptocurrency can have a substantial impact on its price movements. When investors are feeling optimistic about a cryptocurrency, they are more likely to buy, driving up the price. Conversely, when investors are feeling pessimistic, they may sell, causing the price to drop.

The emotional state of investors can be influenced by a variety of factors, including news events, market trends, and social media chatter. Positive news about a cryptocurrency, such as a partnership announcement or a new technological development, can create a sense of optimism among investors, leading to increased buying activity. On the other hand, negative news, such as regulatory crackdowns or security breaches, can trigger fear and uncertainty, prompting investors to sell off their holdings.

Social media platforms like Twitter and Reddit have also become important sources of market sentiment in the cryptocurrency space. Traders often turn to these platforms to gauge the mood of the market and make informed trading decisions. A flurry of positive or negative posts about a particular cryptocurrency can create a snowball effect, influencing the buying or selling behavior of investors.

It is essential for cryptocurrency traders to be aware of the impact of investor emotions on prices and to factor this into their trading strategies. By staying informed about market sentiment and being mindful of their own emotions, traders can make more informed decisions and potentially capitalize on price movements driven by investor sentiment. Ultimately, understanding the role of emotions in cryptocurrency prices can help traders navigate the volatile market more effectively.

Market Sentiment Indicators and Their Influence on Crypto Markets

Market sentiment indicators play a crucial role in influencing the prices of cryptocurrencies. These indicators reflect the overall attitude of investors and traders towards a particular digital asset, which can have a significant impact on its value. Understanding market sentiment is essential for making informed decisions in the volatile world of crypto trading.

One of the most common market sentiment indicators is social media sentiment. Platforms like Twitter, Reddit, and Telegram are often used by traders to discuss and share information about various cryptocurrencies. By analyzing the sentiment expressed in these online conversations, traders can gauge the general mood of the market and make predictions about future price movements.

Another important market sentiment indicator is news sentiment. News articles, blog posts, and press releases can all influence how investors perceive a particular cryptocurrency. Positive news about a project’s development or partnerships can lead to a surge in buying activity, while negative news can cause prices to plummet. Keeping track of news sentiment is crucial for staying ahead of market trends.

Technical analysis is also a valuable tool for measuring market sentiment. By studying price charts and trading volumes, analysts can identify patterns and trends that indicate whether investors are feeling bullish or bearish about a particular cryptocurrency. Technical indicators like moving averages, RSI, and MACD can provide valuable insights into market sentiment and help traders make more informed decisions.

How Fear and Greed Drive Cryptocurrency Price Fluctuations

Market sentiment plays a crucial role in driving cryptocurrency prices, with fear and greed being two primary emotions that influence fluctuations. When investors are driven by fear, they tend to sell off their assets, causing prices to drop. On the other hand, when greed takes over, investors rush to buy, driving prices up.

Fear can be triggered by various factors such as negative news, regulatory crackdowns, or market volatility. This fear leads to panic selling as investors try to minimize their losses, resulting in a downward spiral in prices. Conversely, greed can be fueled by hype, FOMO (fear of missing out), or positive developments in the market. This greed-driven buying frenzy can push prices to unsustainable levels.

Understanding the impact of fear and greed on cryptocurrency prices is essential for investors to make informed decisions. By monitoring market sentiment indicators, such as social media trends, trading volumes, and sentiment analysis tools, investors can gauge the prevailing emotions in the market and adjust their strategies accordingly.

Strategies for Navigating Volatile Crypto Markets Based on Market Sentiment

In navigating volatile crypto markets based on market sentiment, it is crucial to have a solid understanding of the factors that influence price movements. By analyzing market sentiment, traders can gain valuable insights into the overall mood of the market and make more informed decisions about when to buy or sell.

One strategy for navigating volatile crypto markets is to closely monitor social media platforms and news outlets for any information that could impact market sentiment. By staying informed about the latest developments in the crypto space, traders can better anticipate potential price fluctuations and adjust their trading strategies accordingly.

Another effective strategy is to use technical analysis tools to identify key support and resistance levels. By analyzing historical price data, traders can pinpoint levels at which the price is likely to reverse or continue its current trend. This can help traders set realistic price targets and stop-loss orders to minimize potential losses in volatile market conditions.

Additionally, diversifying your crypto portfolio can help mitigate risk in volatile market conditions. By spreading your investments across different cryptocurrencies, you can reduce the impact of price fluctuations in any one asset. This can help protect your overall investment portfolio from significant losses during periods of market volatility.

Overall, by staying informed, using technical analysis tools, and diversifying your portfolio, you can navigate volatile crypto markets based on market sentiment more effectively. By implementing these strategies, you can make more informed trading decisions and increase your chances of success in the ever-changing world of cryptocurrency trading.