How to Trade Cryptocurrencies: A Beginner’s Guide

- Understanding the Basics of Cryptocurrencies

- Choosing the Right Cryptocurrency Exchange Platform

- Creating a Secure Cryptocurrency Wallet

- Developing a Trading Strategy for Cryptocurrencies

- Managing Risks and Setting Realistic Expectations

- Staying Informed About Market Trends and News

Understanding the Basics of Cryptocurrencies

Cryptocurrencies are digital assets that use cryptography for security and operate independently of a central authority, such as a government or financial institution. They are decentralized and typically utilize blockchain technology to record transactions. Understanding the basics of cryptocurrencies is essential for anyone looking to trade them.

One key concept to grasp is that cryptocurrencies are stored in digital wallets, which are secured with private keys. These keys are used to access and manage the funds within the wallet. It is crucial to keep these keys safe and secure, as losing them can result in the loss of the associated cryptocurrencies.

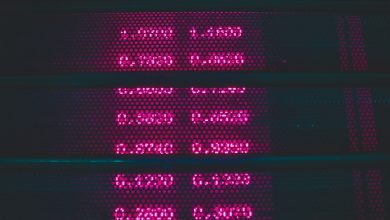

Another important aspect to understand is the volatility of the cryptocurrency market. Prices can fluctuate significantly in a short period, making it a high-risk investment. It is essential to conduct thorough research and stay informed about market trends before trading cryptocurrencies.

Additionally, it is crucial to be aware of the different types of cryptocurrencies available. Bitcoin is the most well-known and widely used cryptocurrency, but there are thousands of others, known as altcoins. Each altcoin has its unique features and use cases, so it is essential to research them before investing.

Overall, trading cryptocurrencies can be a lucrative venture, but it is essential to understand the basics before diving in. By familiarizing yourself with how cryptocurrencies work, the importance of private keys, market volatility, and the variety of cryptocurrencies available, you can make informed decisions and increase your chances of success in the crypto market.

Choosing the Right Cryptocurrency Exchange Platform

When it comes to trading cryptocurrencies, choosing the right exchange platform is crucial. There are many factors to consider when selecting a platform that suits your needs. One of the most important things to look for is security. You want to make sure that the exchange you choose has a good reputation for keeping users’ funds safe. Additionally, you should consider the fees associated with trading on the platform. Some exchanges have high fees, which can eat into your profits. It’s also important to consider the variety of cryptocurrencies available for trading on the platform. You want to make sure that you can access the coins you are interested in buying or selling. Finally, consider the user interface of the exchange. You want to choose a platform that is easy to use and navigate, especially if you are new to trading cryptocurrencies. By taking these factors into account, you can choose the right exchange platform for your trading needs.

Creating a Secure Cryptocurrency Wallet

To ensure the security of your cryptocurrency investments, it is crucial to create a secure cryptocurrency wallet. A cryptocurrency wallet is a digital wallet that allows you to store, send, and receive cryptocurrencies. Here are some tips on how to create a secure cryptocurrency wallet:

1. **Choose a reputable wallet**: When selecting a cryptocurrency wallet, make sure to choose a reputable and trusted provider. Look for wallets that have a good reputation for security and have been around for a while.

2. **Use a hardware wallet**: Consider using a hardware wallet for added security. Hardware wallets are physical devices that store your cryptocurrency offline, making them less vulnerable to hacking.

3. **Enable two-factor authentication**: Two-factor authentication adds an extra layer of security to your wallet by requiring a second form of verification in addition to your password. This can help prevent unauthorized access to your funds.

4. **Backup your wallet**: Make sure to regularly backup your wallet to protect against data loss. Store your backup in a secure location, such as a safe deposit box or encrypted USB drive.

5. **Keep your wallet software up to date**: To protect against security vulnerabilities, make sure to keep your wallet software up to date. Developers often release updates to patch security flaws, so it is important to install these updates promptly.

By following these tips, you can create a secure cryptocurrency wallet to protect your investments from potential threats. Remember to always prioritize security when it comes to managing your cryptocurrencies.

Developing a Trading Strategy for Cryptocurrencies

Developing a trading strategy for cryptocurrencies is essential for success in the volatile market. It is important to carefully consider factors such as risk tolerance, investment goals, and market trends when creating a strategy. One approach is to use technical analysis to identify patterns and trends in price movements. This can help traders make informed decisions about when to buy or sell. Additionally, setting clear entry and exit points can help minimize losses and maximize profits. It is also important to stay informed about news and developments in the cryptocurrency space, as these can have a significant impact on prices. By carefully planning and executing a trading strategy, traders can increase their chances of success in the cryptocurrency market.

Managing Risks and Setting Realistic Expectations

When it comes to trading cryptocurrencies, it is crucial to manage risks effectively and set realistic expectations. Cryptocurrency markets are known for their volatility, which can lead to significant gains or losses in a short period of time. To mitigate risks, it is important to diversify your investment portfolio and only invest what you can afford to lose.

Setting realistic expectations is also key to successful cryptocurrency trading. While it is possible to make substantial profits, it is important to understand that the market can be unpredictable. It is essential to do your research, stay informed about market trends, and avoid making impulsive decisions based on emotions.

One way to manage risks is to use stop-loss orders to automatically sell a cryptocurrency if its price drops to a certain level. This can help limit potential losses and protect your investment. Additionally, setting profit targets can help you take profits at a predetermined price level, preventing greed from clouding your judgment.

It is also important to be aware of external factors that can impact the cryptocurrency market, such as regulatory developments, technological advancements, and market sentiment. By staying informed and being prepared for potential risks, you can make more informed trading decisions and increase your chances of success in the cryptocurrency market.

Staying Informed About Market Trends and News

Staying informed about market trends and news is crucial when trading cryptocurrencies. Keeping up to date with the latest developments can help you make more informed decisions and stay ahead of the curve. Here are some tips to help you stay informed:

- Follow reputable cryptocurrency news websites and blogs to get the latest updates on market trends and news.

- Join cryptocurrency forums and communities to engage with other traders and get insights into the market.

- Sign up for newsletters and alerts from cryptocurrency exchanges and trading platforms to stay informed about new listings and updates.

- Follow key influencers and experts in the cryptocurrency space on social media platforms like Twitter and LinkedIn.

- Attend cryptocurrency conferences and events to network with industry professionals and stay up to date on the latest trends.

By staying informed about market trends and news, you can make more informed trading decisions and increase your chances of success in the cryptocurrency market.