How to Read and Understand Crypto Whitepapers

- Introduction to Crypto Whitepapers

- Breaking Down the Components of a Crypto Whitepaper

- Tips for Analyzing and Evaluating Crypto Whitepapers

- Understanding the Technical Jargon in Crypto Whitepapers

- Common Pitfalls to Avoid When Reading Crypto Whitepapers

- Utilizing Whitepapers to Make Informed Investment Decisions

Introduction to Crypto Whitepapers

Cryptocurrency whitepapers are essential documents that provide detailed information about a specific digital currency project. These whitepapers serve as a roadmap for the project, outlining its goals, technology, and implementation strategy. Understanding how to read and interpret crypto whitepapers is crucial for investors and enthusiasts looking to evaluate the potential of a particular cryptocurrency.

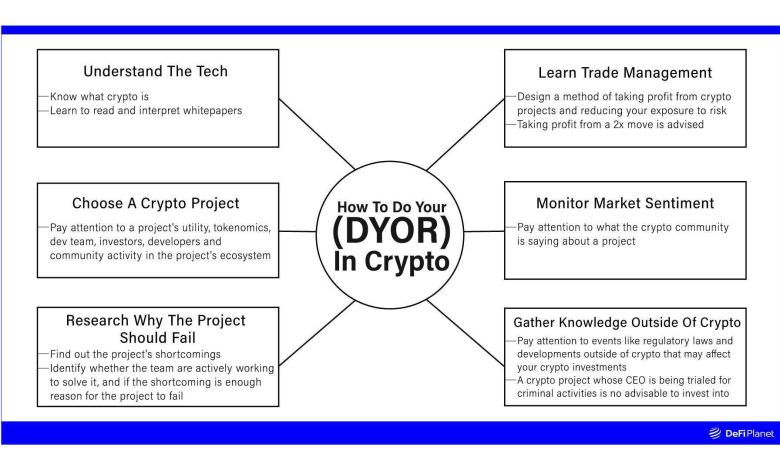

When diving into a crypto whitepaper, it’s important to pay attention to key elements such as the project’s mission statement, technical specifications, tokenomics, and roadmap. By analyzing these components, readers can gain a comprehensive understanding of the project’s purpose and potential for success. Additionally, whitepapers often include information about the team behind the project, their experience, and their vision for the future.

As you navigate through a crypto whitepaper, it’s essential to look for red flags or inconsistencies that may indicate potential risks or shortcomings in the project. By conducting a thorough analysis of the whitepaper, investors can make informed decisions about whether to support the project or not. Remember, not all whitepapers are created equal, so it’s crucial to approach them with a critical eye and a healthy dose of skepticism.

Breaking Down the Components of a Crypto Whitepaper

Cryptocurrency whitepapers are essential documents that provide detailed information about a particular project. When reading a crypto whitepaper, it is crucial to understand the components that make up the document. Breaking down the components of a crypto whitepaper can help you grasp the key aspects of the project and evaluate its potential value.

One of the main components of a crypto whitepaper is the **abstract**. This section provides a brief overview of the project, including its goals, technology, and potential impact. The abstract is usually the first thing you will read in a whitepaper, and it can give you a good idea of what the project is all about.

The **introduction** is another important component of a crypto whitepaper. In this section, the project team introduces themselves and provides background information on the project. The introduction sets the stage for the rest of the whitepaper and helps you understand the context in which the project was developed.

The **problem statement** is a crucial part of a crypto whitepaper. In this section, the project team outlines the problem or challenge that the project aims to solve. Understanding the problem statement is essential for evaluating the relevance and potential impact of the project.

The **solution** section of a crypto whitepaper describes how the project plans to address the problem outlined in the problem statement. This section typically includes details about the technology, features, and benefits of the project. Understanding the solution is key to assessing the feasibility and potential success of the project.

The **token economics** section of a crypto whitepaper provides information about the project’s token, including its distribution, utility, and value proposition. Token economics play a crucial role in determining the long-term viability and sustainability of a project.

In conclusion, breaking down the components of a crypto whitepaper can help you gain a deeper understanding of a project and make informed decisions about investing or participating in it. By carefully analyzing each section of a whitepaper, you can evaluate the project’s potential value and assess its likelihood of success in the competitive cryptocurrency market.

Tips for Analyzing and Evaluating Crypto Whitepapers

When analyzing and evaluating crypto whitepapers, it is essential to approach them with a critical mindset. Here are some tips to help you navigate through the complexities of these documents:

- Start by examining the problem the project aims to solve. Look for a clear and concise explanation of the issue at hand.

- Next, assess the proposed solution. Is it innovative? Does it have the potential to disrupt the industry?

- Scrutinize the technology behind the project. Is it feasible? Are there any red flags or potential vulnerabilities?

- Pay attention to the team behind the project. Do they have the necessary expertise and experience to execute the vision?

- Consider the token economics. Is there a clear utility for the token within the ecosystem?

- Look for a roadmap that outlines the project’s development milestones. Does it seem realistic and achievable?

- Lastly, check for transparency and credibility. Are there any inconsistencies or lack of information that raise concerns?

By following these tips, you can better understand the intricacies of crypto whitepapers and make informed decisions when evaluating potential investment opportunities in the cryptocurrency space.

Understanding the Technical Jargon in Crypto Whitepapers

When reading a crypto whitepaper, it is common to come across technical jargon that may be unfamiliar to the average reader. Understanding this terminology is crucial in grasping the concepts outlined in the document. Here are some key terms you may encounter:

- Blockchain: A decentralized, distributed ledger that records transactions across a network of computers.

- Consensus Mechanism: The method by which a blockchain network agrees on the validity of transactions.

- Smart Contracts: Self-executing contracts with the terms of the agreement directly written into code.

- Tokenomics: The economic model governing the creation, distribution, and management of tokens.

- Decentralized Applications (DApps): Applications that run on a blockchain network without a central authority.

By familiarizing yourself with these terms and their meanings, you can better understand the technical aspects of a crypto whitepaper. This knowledge will enable you to make informed decisions when evaluating a project’s potential for success.

Common Pitfalls to Avoid When Reading Crypto Whitepapers

When reading crypto whitepapers, there are several common pitfalls that readers should be aware of in order to fully understand the content and make informed decisions. Avoiding these pitfalls can help readers navigate the complexities of cryptocurrency projects and assess their potential value accurately.

- Avoid being swayed by hype and promises of quick profits. Many whitepapers use flashy language and bold claims to attract investors, but it’s essential to look beyond the marketing tactics and evaluate the project’s fundamentals carefully.

- Don’t overlook the technical details. Some whitepapers can be dense and filled with complex terminology, but understanding the technology behind a cryptocurrency is crucial to assessing its feasibility and potential for success.

- Be cautious of unrealistic projections and promises. If a whitepaper makes grandiose claims without providing concrete evidence or a realistic roadmap, it may be a red flag that the project is not credible.

- Avoid ignoring the team behind the project. The experience and credentials of the development team can provide valuable insights into the project’s likelihood of success. Look for transparency and track record in the team members.

- Don’t skip the section on token economics. Understanding how tokens are distributed, used, and valued within the ecosystem is essential to evaluating the long-term viability of a cryptocurrency project.

Utilizing Whitepapers to Make Informed Investment Decisions

When it comes to making informed investment decisions in the world of cryptocurrency, utilizing whitepapers can be a valuable tool. Whitepapers are documents that provide detailed information about a specific cryptocurrency project, including its technology, goals, and potential for success. By carefully reading and understanding these whitepapers, investors can gain valuable insights into the project and make more informed decisions about whether or not to invest.

One of the key benefits of whitepapers is that they provide a comprehensive overview of a project, allowing investors to understand the technology behind it and the problem it aims to solve. This information can help investors assess the project’s potential for success and determine whether or not it aligns with their investment goals. Additionally, whitepapers often include details about the project’s team, roadmap, and tokenomics, which can provide further insights into the project’s credibility and long-term viability.

When reading a whitepaper, it is important to pay attention to key details such as the project’s technology, use case, and market potential. Investors should also consider the project’s team and advisors, as well as its roadmap and token distribution. By carefully analyzing these aspects of a whitepaper, investors can make more informed decisions about whether or not to invest in a particular project.

Overall, whitepapers can be a valuable resource for investors looking to make informed decisions in the cryptocurrency space. By carefully reading and understanding these documents, investors can gain valuable insights into a project’s technology, goals, and potential for success, helping them make more informed investment decisions.