Introduction to Cryptocurrencies: What You Need to Know

- What are cryptocurrencies and how do they work?

- The history and evolution of cryptocurrencies

- Key terms and concepts in the world of cryptocurrencies

- Popular cryptocurrencies and their unique features

- Benefits and risks of investing in cryptocurrencies

- How to securely store and manage your cryptocurrency assets

What are cryptocurrencies and how do they work?

Cryptocurrencies are digital assets that use cryptography for security and operate independently of a central authority, such as a government or financial institution. They work on a technology called blockchain, which is a decentralized ledger that records all transactions across a network of computers. This technology ensures transparency and security by making it difficult for any single entity to control the currency or manipulate the system.

One of the key features of cryptocurrencies is their decentralized nature, meaning that they are not controlled by any single entity. Instead, transactions are verified by network participants through a process called mining. Miners use powerful computers to solve complex mathematical problems that validate and secure transactions on the blockchain. In return for their efforts, miners are rewarded with newly minted coins.

Cryptocurrencies can be used for a variety of purposes, including online purchases, investment, and remittances. They offer a level of privacy and security that traditional currencies do not, as transactions are pseudonymous and cannot be easily traced back to individuals. Additionally, cryptocurrencies are not subject to government interference or inflation, making them an attractive option for those seeking financial independence.

Overall, cryptocurrencies are a revolutionary form of digital currency that is changing the way we think about money and finance. As they continue to gain popularity and acceptance, it is important to understand how they work and the potential benefits they offer. Whether you are looking to invest in cryptocurrencies or simply learn more about this emerging technology, it is essential to stay informed and educated on the subject.

The history and evolution of cryptocurrencies

Cryptocurrencies have a rich history that dates back to the early 2000s. The concept of digital currency was first introduced by an individual or group of individuals using the pseudonym Satoshi Nakamoto in 2008. This marked the beginning of the most well-known cryptocurrency, Bitcoin. Since then, cryptocurrencies have evolved significantly, with thousands of different digital currencies now available in the market.

The evolution of cryptocurrencies has been driven by advancements in technology and changes in the financial landscape. As more people began to see the potential of digital currencies, new cryptocurrencies were created to address different needs and challenges. This led to the development of alternative coins, or altcoins, such as Ethereum, Litecoin, and Ripple.

One of the key features of cryptocurrencies is their decentralized nature. Unlike traditional currencies issued by governments, cryptocurrencies operate on a peer-to-peer network without the need for a central authority. This has made cryptocurrencies popular among individuals who value privacy and autonomy in their financial transactions.

Over the years, cryptocurrencies have gained mainstream acceptance, with many businesses and individuals now using them for various purposes. From online purchases to investment opportunities, cryptocurrencies have become a versatile financial tool that continues to grow in popularity.

As the cryptocurrency market continues to evolve, it is important for individuals to stay informed about the latest developments and trends. Understanding the history and evolution of cryptocurrencies can provide valuable insights into how these digital assets work and how they may impact the future of finance. Whether you are a seasoned investor or just getting started with cryptocurrencies, having a solid understanding of their history is essential for making informed decisions in this rapidly changing market.

Key terms and concepts in the world of cryptocurrencies

When delving into the world of cryptocurrencies, it is essential to familiarize yourself with key terms and concepts that are commonly used in this space. Understanding these terms will help you navigate the complex landscape of digital currencies and make informed decisions when investing or trading. Below are some important terms you should know:

- Cryptocurrency: A digital or virtual form of currency that uses cryptography for security and operates independently of a central authority.

- Blockchain: A decentralized, distributed ledger that records all transactions across a network of computers.

- Wallet: A digital tool that allows you to store, send, and receive cryptocurrencies.

- Bitcoin: The first and most well-known cryptocurrency, created by an unknown person or group of people using the pseudonym Satoshi Nakamoto.

- Altcoin: Any cryptocurrency other than Bitcoin, such as Ethereum, Ripple, or Litecoin.

- Mining: The process of validating transactions and adding them to the blockchain using powerful computers.

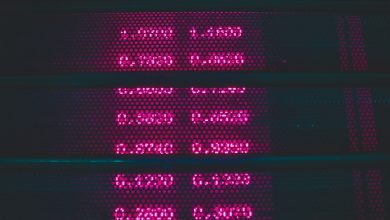

- Exchange: A platform where you can buy, sell, or trade cryptocurrencies for other digital or traditional currencies.

- Wallet: A digital tool that allows you to store, send, and receive cryptocurrencies.

- Decentralization: The distribution of power and control away from a central authority or entity.

- Smart Contract: Self-executing contracts with the terms of the agreement directly written into code.

By familiarizing yourself with these key terms and concepts, you will be better equipped to understand the world of cryptocurrencies and make informed decisions about how to participate in this rapidly evolving industry.

Popular cryptocurrencies and their unique features

When it comes to cryptocurrencies, there are several popular options that investors and users can choose from. Each cryptocurrency has its own unique features that set it apart from the others. Here are some of the most well-known cryptocurrencies and what makes them special:

- Bitcoin: Bitcoin is the first and most well-known cryptocurrency. It was created by an unknown person or group of people using the pseudonym Satoshi Nakamoto in 2009. Bitcoin is decentralized, meaning that it is not controlled by any government or financial institution. It uses blockchain technology to enable secure, anonymous transactions.

- Ethereum: Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). It was proposed by Vitalik Buterin in late 2013 and development began in early 2014, with the network going live on July 30, 2015. Ethereum’s cryptocurrency is called Ether (ETH).

- Ripple: Ripple is a digital payment protocol that enables fast, low-cost cross-border transactions. It was created by Ripple Labs Inc., a technology company founded in 2012. Ripple’s cryptocurrency is called XRP, and it is used by financial institutions to facilitate international money transfers.

- Litecoin: Litecoin is a peer-to-peer cryptocurrency created by Charlie Lee in 2011. It is based on the Bitcoin protocol but with some differences, such as a faster block generation time and a different hashing algorithm. Litecoin is often referred to as the “silver to Bitcoin’s gold.”

- Cardano: Cardano is a blockchain platform that aims to provide a more secure and scalable infrastructure for the development of decentralized applications and smart contracts. It was founded by Charles Hoskinson, one of the co-founders of Ethereum, in 2017. Cardano’s cryptocurrency is called ADA.

These are just a few examples of the many cryptocurrencies that exist in the market today. Each cryptocurrency has its own unique features and use cases, making it important for investors and users to do their research before deciding which ones to invest in or use for transactions.

Benefits and risks of investing in cryptocurrencies

Investing in cryptocurrencies can offer a range of benefits, but it also comes with its fair share of risks. One of the main advantages of investing in cryptocurrencies is the potential for high returns. The value of cryptocurrencies can fluctuate significantly, providing opportunities for investors to make substantial profits. Additionally, cryptocurrencies offer a level of anonymity and security that traditional forms of investment may not provide.

However, it is important to be aware of the risks associated with investing in cryptocurrencies. One of the main risks is the volatility of the market. Cryptocurrency prices can be highly unpredictable, leading to potential losses for investors. Furthermore, the lack of regulation in the cryptocurrency market can make it vulnerable to fraud and scams. Investors should also be cautious of security breaches and hacking incidents that can result in the loss of their investments.

In conclusion, while investing in cryptocurrencies can be lucrative, it is essential to carefully consider the risks involved. By staying informed and being cautious, investors can navigate the cryptocurrency market successfully and potentially reap the benefits it has to offer.

How to securely store and manage your cryptocurrency assets

When it comes to **securely storing and managing** your **cryptocurrency assets**, there are several important steps you should take to protect your investments. **Cryptocurrencies** are digital assets that require a different approach to security than traditional **financial assets**. Here are some **tips** to help you keep your **cryptocurrency** safe:

- Use a **hardware wallet** to store your **cryptocurrency**. Hardware wallets are physical devices that store your **private keys** offline, making them less vulnerable to **hacks** and **cyber attacks**.

- Enable **two-factor authentication** on all of your **cryptocurrency** accounts. This adds an extra layer of security by requiring a **second form** of **verification** in addition to your **password**.

- Keep your **private keys** secure and never share them with anyone. Your **private keys** are what allow you to access your **cryptocurrency** holdings, so it’s crucial to keep them **private**.

- Consider using a **multi-signature wallet** for added security. **Multi-signature wallets** require multiple **private keys** to authorize a **transaction**, making it more difficult for **hackers** to steal your **cryptocurrency**.

- Regularly update your **wallet software** to ensure you have the latest security patches and **features**. **Developers** are constantly working to improve the security of **cryptocurrency wallets**, so it’s important to stay up to date.

By following these **best practices** for **securely storing and managing** your **cryptocurrency assets**, you can help protect your **investments** from **cyber threats** and **security breaches**. Remember, the **security** of your **cryptocurrency** is ultimately your responsibility, so it’s important to take **precautions** to keep your **assets** safe.